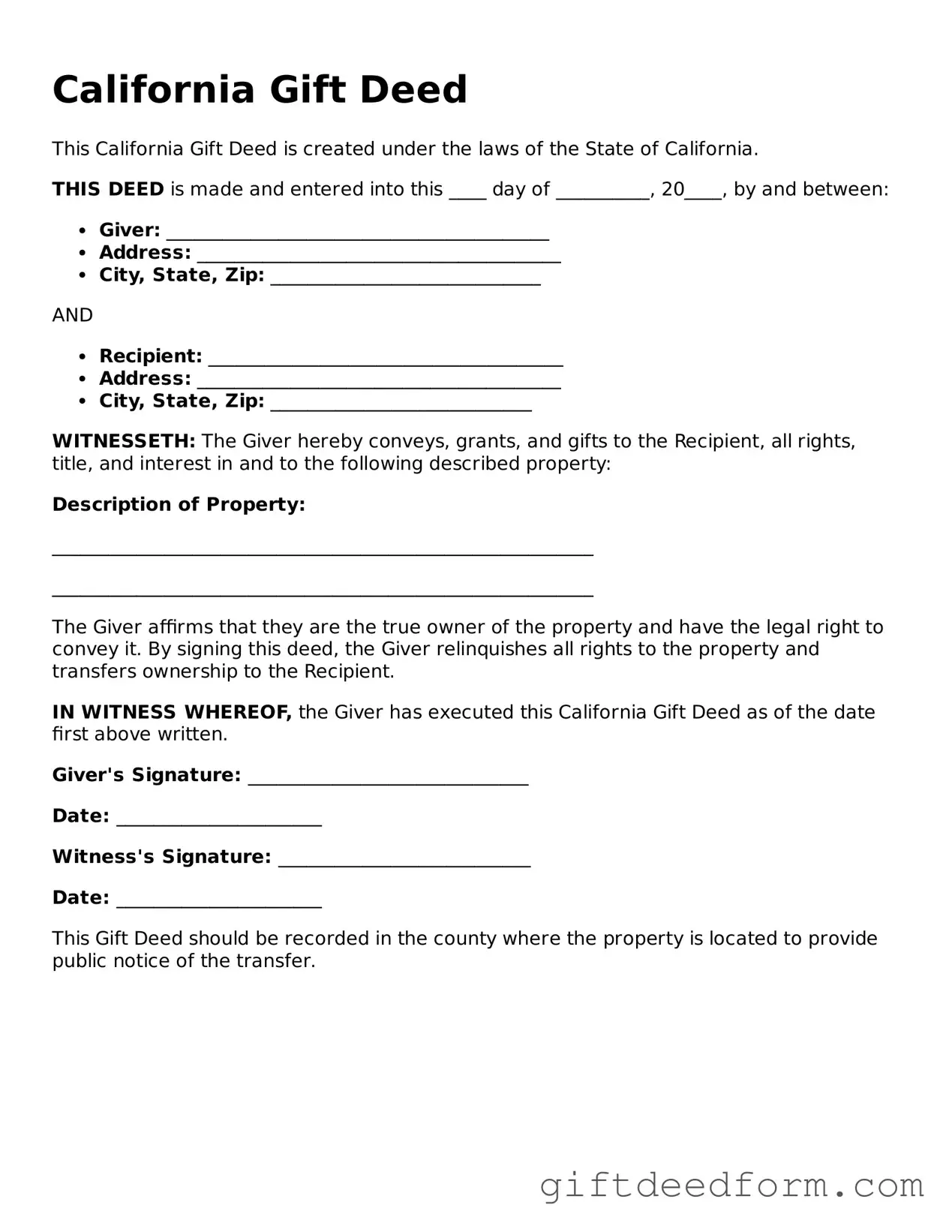

Legal California Gift Deed Document

More State-specific Gift Deed Forms

Virginia Transfer Taxes - Adding witnesses to the signing of a Gift Deed can strengthen its validity.

What Is a Gift Deed in Texas - The document can help simplify the process of estate planning and gift giving.

How to Transfer Property Deed in Georgia - This form is often accompanied by a witness signature to validate the gift transfer.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The California Civil Code, specifically Sections 11911-11923, governs the use of Gift Deeds in California. |

| Requirements | The deed must be in writing, signed by the donor, and must include a description of the property being gifted. |

| Recording | To be effective against third parties, the Gift Deed must be recorded with the county recorder's office where the property is located. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liabilities, which should be considered by the donor. |

| Revocation | A Gift Deed cannot be revoked once executed and delivered, unless the donor retains a life estate in the property. |

| Use Cases | Commonly used to transfer property between family members, such as parents gifting property to their children. |

Documents used along the form

When completing a California Gift Deed, it's often helpful to have additional forms and documents on hand. These documents can streamline the process and ensure that all legal requirements are met. Below are some key forms that are commonly used alongside the Gift Deed.

- Preliminary Change of Ownership Report: This form is typically required by the county assessor’s office when a property changes hands. It provides important details about the transfer and helps the county assess property taxes accurately.

- Grant Deed: Although a Gift Deed is specifically for transferring property as a gift, a Grant Deed can also be used for property transfers. It serves as a formal document that conveys ownership and includes warranties regarding the title.

- Property Tax Exemption Application: If the gift of property qualifies for certain tax exemptions, this application allows the new owner to request relief from property taxes. It’s essential for ensuring that the recipient benefits from any available tax breaks.

- Room Rental Agreement: Before renting out a room in California, it's crucial to have a comprehensive Room Rental Agreement to ensure clarity on the terms and conditions between the landlord and tenant.

- Affidavit of Value: This document can be used to declare the fair market value of the property being gifted. It may be necessary for tax purposes and helps clarify the value of the transaction for both parties involved.

Having these forms ready can help facilitate a smoother transfer process. Always ensure that you understand the requirements for each document to avoid any complications down the line.

Key takeaways

When filling out and using the California Gift Deed form, it is important to keep several key points in mind. Understanding these aspects will help ensure the process goes smoothly.

- The Gift Deed is used to transfer property without any exchange of money.

- Both the giver (donor) and the recipient (donee) must be clearly identified on the form.

- Property descriptions should be precise and include the legal description to avoid confusion.

- The form must be signed by the donor in the presence of a notary public.

- Once completed, the Gift Deed must be recorded with the county recorder's office to be legally effective.

- There may be tax implications for both parties, so consulting a tax professional is advisable.

- The Gift Deed should explicitly state that the transfer is a gift to avoid any future disputes.

- It is recommended to keep a copy of the recorded Gift Deed for personal records.

- Ensure that all parties involved understand their rights and responsibilities regarding the property after the transfer.

Common mistakes

Filling out the California Gift Deed form can be straightforward, but mistakes can lead to complications. One common error is failing to provide accurate property descriptions. The property must be clearly identified, including the address and legal description. Omitting this information or providing vague details can create confusion and may result in legal challenges.

Another frequent mistake is not including the correct names of the parties involved. The grantor, or the person giving the gift, and the grantee, or the person receiving the gift, must be clearly stated. If there are any discrepancies in the names, such as misspellings or incorrect titles, this can invalidate the deed.

Many individuals also overlook the necessity of signatures. Both the grantor and the grantee must sign the form for it to be valid. In some cases, people forget to have the deed notarized. Notarization is an essential step that verifies the identities of those signing the document, adding an extra layer of protection against fraud.

Lastly, individuals often neglect to consider tax implications. While a gift deed can help avoid probate, it may have consequences for property taxes and gift taxes. It is crucial to understand these implications before completing the form. Consulting with a tax professional can help clarify these issues and ensure compliance with tax laws.

Similar forms

- Will: A will outlines how a person’s assets should be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only after death, while a gift deed is effective immediately.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Similar to a gift deed, it involves the transfer of property, but a trust can manage assets over time, whereas a gift deed is a straightforward transfer.

- Quitclaim Deed: A quitclaim deed transfers a person’s interest in a property without any guarantees. Both documents facilitate the transfer of property, but a quitclaim deed does not provide the same assurances regarding ownership as a gift deed does.

- Sale Deed: A sale deed is used to transfer ownership of property in exchange for payment. While both documents transfer property, a sale deed involves a financial transaction, whereas a gift deed is a transfer without consideration.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. Both documents involve property rights, but a lease does not transfer ownership, while a gift deed does.

- Deed of Trust: A deed of trust secures a loan with real property. It’s similar to a gift deed in that it involves property, but it is used primarily for securing debt rather than transferring ownership outright.

- Power of Attorney: A power of attorney allows one person to act on behalf of another in legal matters. While it can facilitate property transfers, it does not itself transfer ownership like a gift deed does; instead, it authorizes someone to act in another’s stead.

Dos and Don'ts

When filling out the California Gift Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six essential do's and don'ts:

- Do provide accurate information about the donor and the recipient.

- Do clearly describe the property being gifted.

- Do ensure that all signatures are present and properly dated.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use whiteout or correction fluid on the form; errors should be crossed out and initialed.

- Don't forget to have the form notarized to validate the gift deed.

By following these guidelines, you can help ensure that your Gift Deed is properly executed and legally binding.