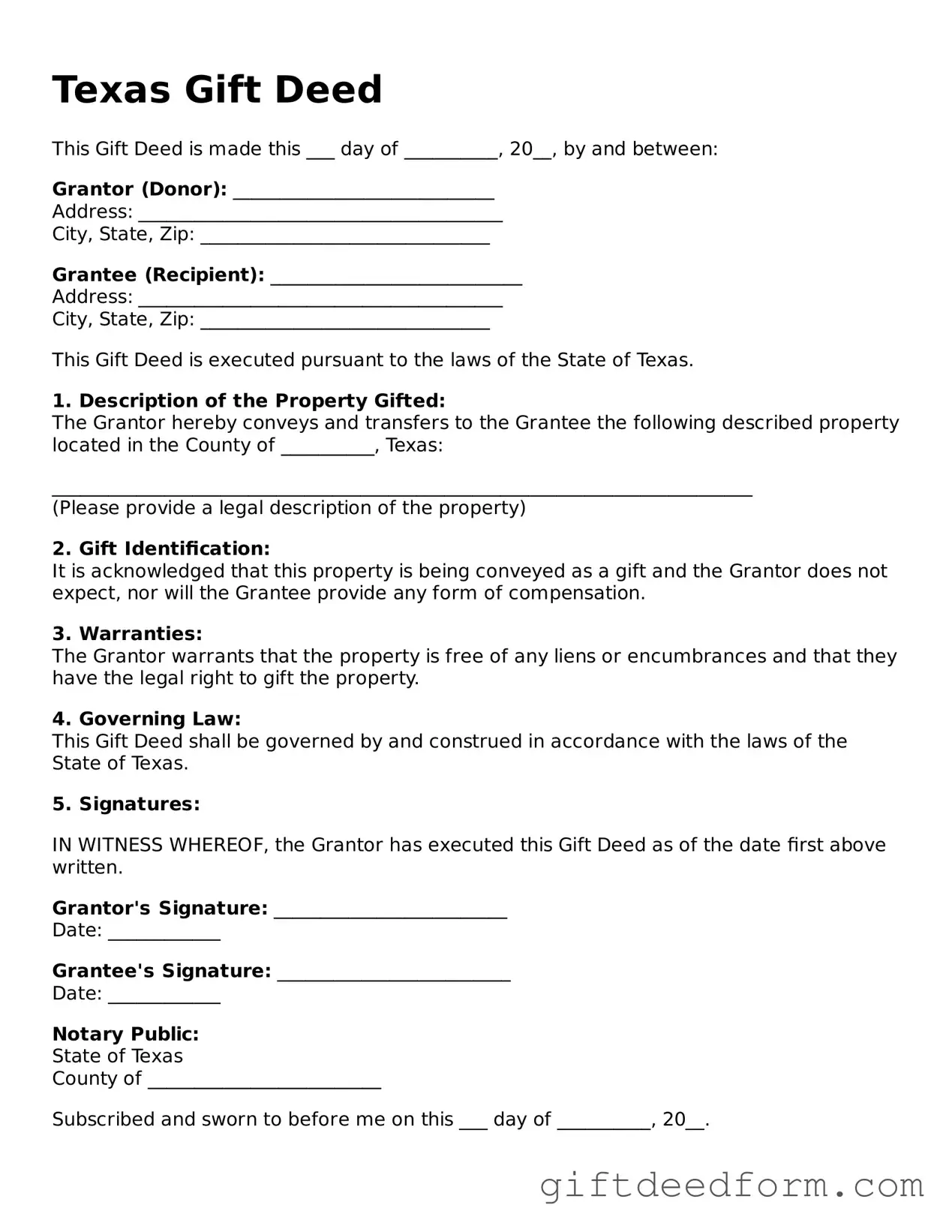

Legal Texas Gift Deed Document

More State-specific Gift Deed Forms

How to Add Name to House Title in California - A Gift Deed can help protect relationships by providing clarity regarding the terms of the gift.

Virginia Transfer Taxes - No payment is required from the recipient when using a Gift Deed.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | A Texas Gift Deed is used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Requirements | The deed must be in writing, signed by the grantor, and should be notarized to be valid. |

| Tax Implications | Gifts may have tax implications. It's important to consider federal gift tax regulations when using a Gift Deed. |

Documents used along the form

The Texas Gift Deed form is an essential document for transferring property as a gift without monetary exchange. When preparing this form, several other documents may be necessary to ensure a smooth and legally compliant transfer. Below is a list of related forms and documents commonly used in conjunction with the Texas Gift Deed.

- Property Title Document: This document proves ownership of the property being gifted. It provides essential details about the property, including the legal description and any existing liens or encumbrances.

- Affidavit of Gift: This sworn statement confirms that the transfer of property is a gift and not a sale. It may include details about the relationship between the donor and the recipient.

- Transfer Tax Exemption Form: This form is used to claim an exemption from transfer taxes when property is gifted. It helps clarify that the transaction is not subject to taxation due to its nature as a gift.

- Power of Attorney: If the donor is unable to sign the Gift Deed in person, a Power of Attorney may be needed. This document allows someone else to act on behalf of the donor in executing the deed.

- Notice of Gift: This document serves as a formal notification to any interested parties regarding the transfer of property as a gift. It may be recorded in the public records to provide notice to third parties.

- Gift Tax Return (IRS Form 709): If the value of the gift exceeds the annual exclusion limit, the donor may need to file this form with the IRS. It reports the gift and ensures compliance with federal tax regulations.

- Deed of Trust: In some cases, if the property has existing loans, a Deed of Trust may be necessary. This document secures the loan and outlines the terms under which the property can be transferred.

- Real Property Inventory: This document lists all real property owned by the donor. It may be useful for estate planning purposes and provides a comprehensive overview of the donor's assets.

- Beneficiary Designation Forms: If the property is part of a trust or estate plan, these forms designate who will receive the property upon the donor's passing. They ensure that the donor's wishes are followed.

Using these documents in conjunction with the Texas Gift Deed can help streamline the process of transferring property as a gift. It is advisable to consult with a professional to ensure all necessary paperwork is completed correctly and efficiently.

Key takeaways

When filling out and using the Texas Gift Deed form, it is essential to keep several key points in mind to ensure a smooth process.

- Clear Identification of Parties: Clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift). Include full names and addresses to avoid confusion.

- Property Description: Provide a detailed description of the property being gifted. This includes the address and any legal descriptions necessary to identify the property accurately.

- Intent to Gift: Clearly state the intention to gift the property. This can help prevent any disputes regarding the donor's intentions in the future.

- Signatures and Notarization: Ensure that both the donor and recipient sign the form. It is also advisable to have the deed notarized to add an extra layer of authenticity and legality.

By following these guidelines, you can effectively complete the Texas Gift Deed form, making the transfer of property clear and legally binding.

Common mistakes

Filling out the Texas Gift Deed form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is not providing complete and accurate property descriptions. The property must be clearly identified, including its legal description. Omitting this detail can cause confusion and disputes later on.

Another mistake is failing to include the correct names of the parties involved. Both the donor and the recipient must be identified properly. If there are any discrepancies in the names, such as misspellings or using nicknames, it could invalidate the deed.

People often forget to sign the document. A Gift Deed must be signed by the donor to be legally binding. In some cases, individuals assume that a verbal agreement is sufficient, but without a signature, the deed holds no legal weight.

Additionally, not having the deed notarized is a common oversight. In Texas, a Gift Deed must be acknowledged before a notary public to ensure its validity. Skipping this step can lead to challenges in proving the deed’s authenticity.

Some individuals mistakenly believe that a Gift Deed does not require witnesses. However, while Texas does not mandate witnesses for a Gift Deed, having them can provide additional proof if disputes arise. It’s better to err on the side of caution.

Another mistake is neglecting to consider tax implications. While gifts may not always be taxable, failing to understand the potential tax consequences can lead to unexpected financial burdens. Consulting with a tax professional can help clarify these issues.

People also often overlook the need to record the Gift Deed with the county clerk. Even if the deed is completed correctly, it must be filed to put the public on notice of the transfer. Without this step, the deed may not protect the recipient's ownership rights.

Lastly, many individuals do not keep a copy of the completed Gift Deed for their records. Retaining a copy is essential for future reference and can be critical if any questions about the gift arise. Always ensure you have documentation of the transaction.

Similar forms

- Quitclaim Deed: This document transfers ownership of property without any guarantees. Like a Gift Deed, it can be used to transfer property between family members or friends, often without monetary exchange.

- Room Rental Agreement: This document serves as an essential legal form for renting a room. It delineates the expectations between landlords and tenants, ensuring that all parties understand their rights and responsibilities, as highlighted in the Room Rental Agreement.

- Warranty Deed: This type of deed provides a guarantee that the grantor holds clear title to the property. While a Gift Deed does not offer such assurances, both serve to transfer property ownership.

- Bill of Sale: A Bill of Sale is used to transfer ownership of personal property, such as vehicles or equipment. Similar to a Gift Deed, it can facilitate the transfer without monetary compensation.

- Trust Agreement: A Trust Agreement establishes a fiduciary relationship for managing assets. Both documents can be utilized for estate planning purposes, allowing for the transfer of property to beneficiaries.

- Real Estate Purchase Agreement: This document outlines the terms of a property sale. While it typically involves payment, it shares the purpose of formalizing a property transfer like a Gift Deed.

- Lease Agreement: A Lease Agreement allows for the temporary use of property. Though it does not transfer ownership, it similarly governs the use of property between parties.

- Power of Attorney: A Power of Attorney grants someone the authority to act on behalf of another. It can be used to facilitate property transfers, similar to how a Gift Deed conveys ownership.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. It can support the transfer of property without a will, akin to how a Gift Deed transfers property during the grantor's lifetime.

- Property Transfer Tax Return: This form is often required when transferring property. While it is not a deed itself, it is associated with the process of transferring property ownership, much like a Gift Deed.

Dos and Don'ts

When filling out the Texas Gift Deed form, it’s essential to follow specific guidelines to ensure the process goes smoothly. Here’s a list of what to do and what to avoid:

- Do ensure that the property description is accurate and complete.

- Do include the full names of both the giver and the recipient.

- Do sign the form in the presence of a notary public.

- Do check for any specific state requirements that may apply to your situation.

- Don't leave any sections of the form blank; this can cause delays.

- Don't forget to date the form at the time of signing.

- Don't use vague language when describing the property.

- Don't overlook the need for witnesses, if required by your local jurisdiction.