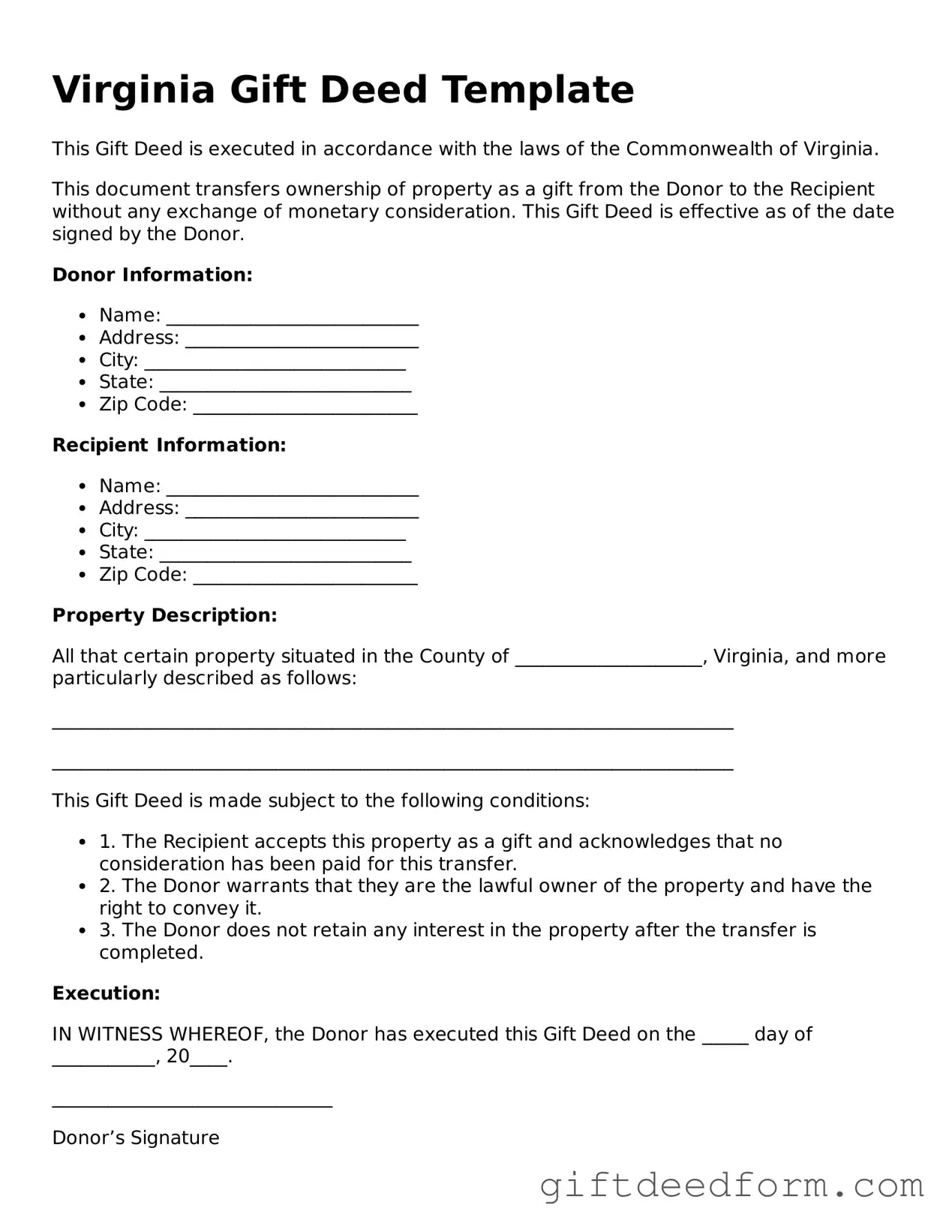

Legal Virginia Gift Deed Document

More State-specific Gift Deed Forms

What Is a Gift Deed in Texas - This document serves as a vital record for both parties involved in the property transfer.

How to Add Name to House Title in California - It's often recommended to keep a copy of the Gift Deed for future reference after the transaction is complete.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Virginia Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Virginia Gift Deed is governed by the Code of Virginia, specifically § 55.1-600 through § 55.1-614. |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be legally valid. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from other types of property transfers. |

| Tax Implications | Gift tax may apply, and the donor should consult a tax professional to understand potential liabilities. |

| Recording | To protect the rights of the recipient, the deed should be recorded in the local land records office where the property is located. |

| Revocation | Once executed and delivered, a gift deed generally cannot be revoked without the consent of the recipient. |

| Legal Advice | It is advisable to seek legal counsel when preparing a gift deed to ensure compliance with all legal requirements. |

Documents used along the form

When completing a Virginia Gift Deed, it is often beneficial to have additional documents on hand to ensure a smooth transfer of property and to comply with legal requirements. Here are some commonly used forms and documents that complement the Gift Deed.

- Property Title Search: This document provides a history of the property, including previous ownership and any liens or encumbrances. It helps verify that the donor has clear title to the property being gifted.

- Affidavit of Consideration: This sworn statement outlines the value of the property being transferred and confirms that the transfer is a gift. It is often required to clarify that no monetary exchange is involved.

- Transfer Tax Exemption Form: In Virginia, certain gift transfers may be exempt from transfer taxes. This form helps to document the exemption and ensures compliance with tax regulations.

- Witness Signature Form: While not always necessary, having a witness sign the Gift Deed can add an extra layer of validity. This document captures the witness's information and signature, affirming they observed the signing of the Gift Deed.

Having these documents ready can simplify the gifting process and help prevent potential disputes or legal issues down the line. It is always advisable to consult with a legal professional to ensure all necessary paperwork is correctly completed and filed.

Key takeaways

When filling out and using the Virginia Gift Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Gift Deed transfers property ownership without any exchange of money. It's essential to know that this is a voluntary act.

- Identify the Parties: Clearly list the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Property: Provide a detailed description of the property being gifted. This includes the address and any relevant property identification numbers.

- Signatures Required: The donor must sign the deed. If the donor is married, the spouse should also sign to relinquish any claim to the property.

- Notarization: The Gift Deed must be notarized. This adds an extra layer of authenticity and can help avoid disputes in the future.

- Filing the Deed: After completing and notarizing the Gift Deed, file it with the local circuit court. This ensures the transfer is legally recognized.

- Tax Implications: Be aware of potential gift tax implications. Consult a tax professional to understand any obligations that may arise from the transfer.

- Revocation: Once the Gift Deed is executed and recorded, it cannot be easily revoked. Make sure you are certain about the decision to transfer the property.

- Consult Legal Help: If unsure about any part of the process, seek legal assistance. A professional can guide you through the details and ensure compliance with Virginia law.

Common mistakes

Filling out a Virginia Gift Deed form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to provide complete information about the donor and the recipient. Both parties must be clearly identified, including their full names and addresses. Omitting even a small detail can create confusion or invalidate the deed.

Another mistake is not properly describing the property being gifted. The description should be precise and detailed, including the property's address and any relevant identifying information, such as parcel numbers. Vague descriptions can lead to disputes or issues with future property transfers.

People often overlook the importance of signatures. Both the donor and the recipient must sign the deed. In some cases, individuals may think that only the donor's signature is necessary, but the recipient's signature is also crucial for the deed to be valid.

Not having the deed notarized is a common oversight. In Virginia, a Gift Deed must be notarized to be legally binding. Without a notary's acknowledgment, the document may not hold up in court or during property transactions.

Another mistake is neglecting to record the Gift Deed with the local land records office. Recording the deed is essential for establishing the new ownership publicly. Failing to do so can lead to complications if the recipient later tries to sell or mortgage the property.

Some individuals forget to check for any existing liens or mortgages on the property. If there are outstanding debts tied to the property, the recipient could inadvertently inherit those financial obligations. It’s wise to conduct a title search before finalizing the gift.

People may also misunderstand the tax implications of gifting property. While Virginia does not impose a gift tax, there could be federal tax considerations. Failing to consult with a tax professional can result in unexpected financial consequences for both the donor and the recipient.

Another common error is not including any conditions or restrictions related to the gift. If there are specific terms that the donor wishes to impose, such as the property being used for a particular purpose, these should be clearly stated in the deed.

Some individuals may rush through the process, thinking that the Gift Deed is a simple document. However, taking the time to review and ensure accuracy is crucial. Mistakes made in haste can lead to costly delays and legal issues.

Lastly, neglecting to seek legal advice can be a significant misstep. While the form may seem straightforward, the implications of a gift deed can be complex. Consulting with a legal professional can help avoid pitfalls and ensure that the deed is executed correctly.

Similar forms

-

Will: A will is a legal document that outlines how a person's assets will be distributed after their death. Similar to a gift deed, it allows individuals to transfer property, but a will takes effect only upon death, whereas a gift deed transfers ownership immediately.

-

Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Like a gift deed, it involves transferring ownership, but a trust can manage assets during the grantor's lifetime and beyond.

-

Quitclaim Deed: A quitclaim deed is used to transfer interest in real property without guaranteeing that the title is clear. This document is similar to a gift deed in that it transfers ownership but does not provide the same level of assurance regarding the property's title.

-

Sales Contract: A sales contract outlines the terms of a sale between a buyer and seller. While a gift deed transfers property without compensation, a sales contract involves an exchange of money or services in return for property.

-

Deed of Trust: A deed of trust secures a loan by transferring the title of property to a trustee until the borrower repays the debt. Similar to a gift deed, it involves property transfer, but it serves as collateral for a loan rather than a gift.

-

Room Rental Agreement: The Room Rental Agreement is essential for outlining the responsibilities of both landlords and tenants in residential room rentals, ensuring clarity and legal protection for both parties.

-

Power of Attorney: A power of attorney allows one person to act on behalf of another in legal or financial matters. While it does not transfer ownership like a gift deed, it can enable the agent to make gifts or transfers of property on behalf of the principal.

Dos and Don'ts

When filling out the Virginia Gift Deed form, it is important to approach the process with care. Here are some essential dos and don'ts to keep in mind:

- Do ensure that the names of the donor and recipient are correctly spelled and clearly stated.

- Do provide accurate property descriptions, including the address and any relevant parcel numbers.

- Do check that the form is signed by the donor in the presence of a notary public.

- Do keep a copy of the completed Gift Deed for your records.

- Don't leave any fields blank; all sections must be completed to avoid delays.

- Don't use outdated forms; always use the most current version of the Gift Deed.

- Don't forget to review the form for any errors before submitting it.

- Don't assume that verbal agreements are sufficient; written documentation is necessary.

- Don't forget to file the completed Gift Deed with the appropriate local government office.